What is a Reverse Mortgage?

Who Can Benefit from a Reverse Mortgage?

How Do Reverse Mortgages Work?

Qualifications and Requirements

Beyond being at least 62 years old, other reverse mortgage requirements are pretty simple and easy to qualify for. Let’s consider what it takes to be eligible for a reverse mortgage.

1. Property Type

2. Equity and Fees

- An up-front insurance premium

- An origination fee

- Standard closing costs

- Mortgage insurance premiums (MIPs)

- Interest

- Loan servicing fees

3. Counseling

The HUD requires borrowers to complete an approved counseling session before receiving a reverse mortgage loan. The session costs around $125 and lasts 90 minutes. You’ll learn everything you need to know about the loan.

4. Collateral Protection

You must stay current on homeowner’s association fees, insurance, and property taxes. Regardless of the reason, you'll have to repay the loan if you don’t live in the house for over a year.

Benefits of Reverse Mortgages

Reverse mortgages can be a great opportunity for senior investors. Let’s look at some of their many benefits.

1. Additional Income for Retirees

Reverse mortgages are perfect for retirees who may not have many cash savings or investments. This loan will let them turn their illiquid assets into additional income if they have accumulated enough wealth in their properties.

2. Keeping the Property

You won’t need to sell your home to liquify your assets. With a reverse mortgage, you can keep living in the property while you get cash out of it. This way, you won’t get priced out of your neighborhood or worry about downsizing.

3. Paying Off Existing Home Loan

You don’t need to pay off your home before you borrow a reverse mortgage. You can use the loan’s proceeds to pay your existing home loan, freeing up money for other expenses.

4. Tax Liability

As we mentioned, the IRS considers proceeds from a reverse mortgage to be a loan advanced instead of an income. That means these proceeds don’t have any tax liability.

.png)

Drawbacks and Considerations

1. Possibility of Foreclosure:

2. Heirs need to repay the loan when the borrower passes away:

.png)

Types of Reverse Mortgages

-

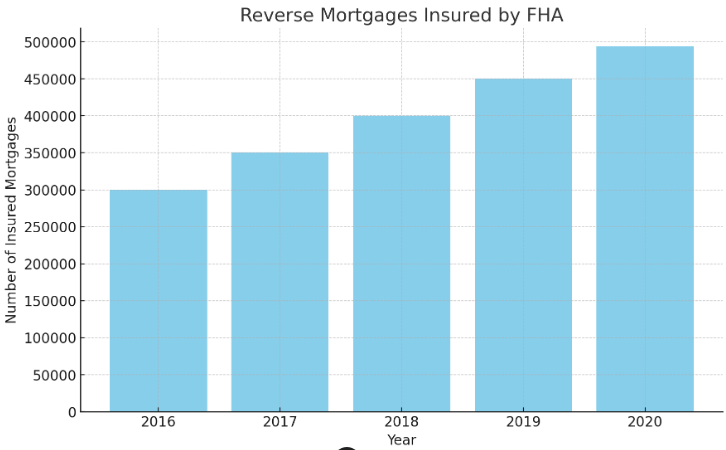

Home Equity Conversion Mortgages (HECMs): HECMs are the type you’re most likely to get. They’re also called FHA reverse mortgages since they only come from FHA-approved lenders.

-

Proprietary Reverse Mortgages: This loan allows you to borrow up to $4 million in equity. They don’t have the same regulations as an HECM, making them more susceptible to scams.

-

Single-Purpose Reverse Mortgages: These loans let homeowners aged 62+ borrow against their home equity for a specific, approved purpose (like property taxes or home repairs). They tend to have lower fees and better rates than other reverse mortgages.

Application Process

The process of applying for and receiving a reverse mortgage is pretty simple. Let’s walk you through it.

- Consult a loan officer: First, meet with a reverse mortgage loan officer to discuss your financial situation and see if this type of loan is right for you.

- Attend HUD-approved counseling: Federal law requires you to go through counseling with a HUD-approved agency. This is the safest way for you to fully understand the terms, costs, and risks of a reverse mortgage.

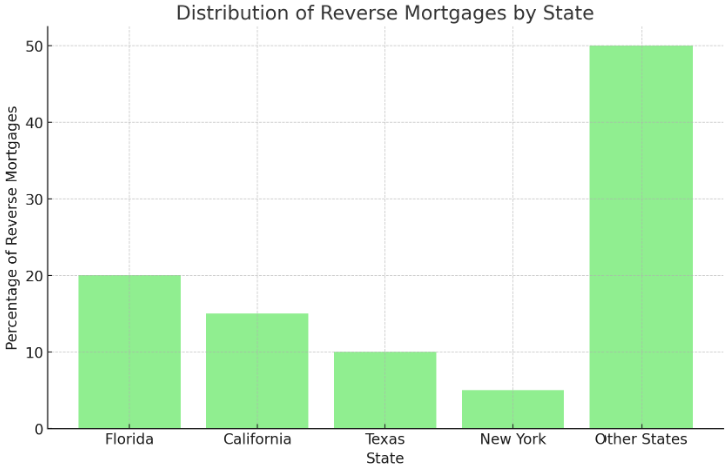

- File your application: Submit your reverse mortgage application to your chosen lender. If you're in Texas, you have a seven-day cooling-off period after counseling to decide. During this period, lenders cannot charge fees or order services.

- Home appraisal: An appraisal will determine your home's value and how much you can borrow.

- Review the loan agreement: Once approved, carefully review the loan agreement. Hiring an expert financial advisor to help you understand the fine print may be wise.

- Receive your funds: You can receive the loan funds in one go, as a line of credit, or via monthly payments.

Reverse Mortgages Vs Home Equity Loans/HELOCs

Managing a Reverse Mortgage

1. Fixed Rate Options

First, determine whether a fixed or adjustable-rate reverse mortgage better suits your financial needs. In most cases, fixed-rate loans are much better since they're stable and predictable throughout the loan's life. Adjustable-rate options may be more affordable initially, but they can add up over time. Luckily, there are limits to how much the rate can change – no more than 5% over the original rate for jumbo reverse mortgages.

2. Refinancing

- If the current market conditions are too dynamic or you've found a better rate option. Refinancing lets you replace your current mortgage loan with a new one with more favorable terms, such as lower interest rates or reduced fees.

- If your spouse didn’t meet the reverse mortgage age requirements when you first obtained the loan, but they’re now old enough, you can add them to the loan as part of a refinance.

- To cash in equity that’s built up since you first took out your reverse mortgage. This could be especially true in today’s real estate market. Refinancing an old reverse mortgage could unlock tens or hundreds of thousands of dollars in new equity, and give you even more cash flow for your retirement.

One specific requirement of a reverse mortgage refinance is that you must have had the existing loan for at least 18 months. Besides this, the usual reverse mortgage requirements apply to your refinance.

3. Hire a Financial Advisor

Consult a professional financial advisor if your reverse mortgage rates affect your financial health. They'll show you the right course of action based on your current goals, budget, and loan terms.

Conclusion

Reverse mortgages are an excellent option for seniors with substantial equity in their homes. It allows them to avoid monthly payments and make the most of their property before they pass away, sell it, or move out. But navigating the world of reverse mortgages, that too post-retirement may be difficult for most. That’s why it is very important to hire and work with professionals who can make the process and your life easier. Our team at Equity Access Group has a proven record of getting you the most out of your home equity, you can contact us here to get started and enjoy the home equity you deserve!

Free Reverse Mortgage Fact Kit

See what a reverse mortgage can do for your finances. Get your free, no-obligation kit today.