Jumbo Reverse Mortgage

You can find numerous financial plans for retirement planning to secure your future. A jumbo reverse mortgage is the best retirement plan for people with high-value houses. It allows you to access sufficient home equity while still living there.

A jumbo reverse mortgage is a great source of funds for retired civilians with a luxury house. This guide will explain everything you need to know about the Jumbo Reverse Mortgage, its benefits, and the qualification process.

What is a Jumbo Reverse Mortgage?

A jumbo reverse mortgage, also known as a proprietary reverse mortgage, is a financial plan designed for individuals with high-value properties. However, this type of loan is not insured by the federal government.

It also does not have a government-regulated cap like a Home Equity Conversion Mortgage (HECM). With a larger loan amount, you can greatly improve your post-retirement life.

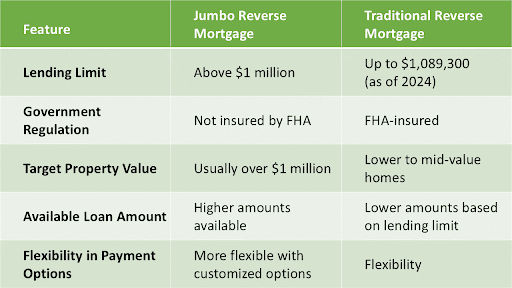

Jumbo Reverse Mortgage vs Traditional Reverse Mortgage

Understanding the difference between jumbo reverse mortgages and traditional reverse mortgages is necessary. The traditional reverse mortgage, aka Home Equity Conversion Mortgage, is a federally regulated loan amount. As of 2024, its lending limit was $1,089,300 to $1,149,825.

This limit may not be enough for people with higher-value homes. With the help of Jumbo reverse mortgage, you can get loans above this FHA cap. Sometimes, the loan amount may even reach millions, which is normal for this type of loan.

How Does a Jumbo Reverse Mortgage Work?

Like the traditional reverse mortgage, the jumbo reverse mortgage allows the homeowner above the age of 62 to access a significant amount. This loan amount is repaid when the homeowner passes away. If the loan amount is paid in full before the owner passes away, the property can go to the heirs after their passing.

However, if the loan amount remains, the lender sells the property to complete the payments. The borrower can use the loan amount to improve their lifestyle, pay medical bills, or invest in a business.

Benefits of a Jumbo Reverse Mortgage

The several benefits of a jumbo reverse mortgage loan include:

Access to More Equity

The biggest benefit of a jumbo reverse mortgage is access to more of your home's equity. If you own a high-value house, a traditional reverse mortgage will not offer sufficient funds to facilitate your post-retirement lifestyle. With a Jumbo reverse mortgage, you will have a high loan amount. It becomes a substantial financial resource after retirement.

No Monthly Mortgage Payments

Like traditional reverse mortgages, Jumbo reverse mortgages require no monthly mortgage payments. This can greatly decrease your financial load in retirement, allowing you to allocate your income to other bills or investments.

Flexibility in Payment Options

Jumbo reverse mortgages allow you to choose how you want to get your funds. You can receive a lump sum, monthly installments, a line of credit, or a mix of the above. This flexibility lets you personalize the loan to your specific financial circumstances and retirement plans.

Retain Ownership of Your Home

With a jumbo reverse mortgage, you get to keep ownership of your house. You can live in your house for as long as you like, as long as you follow the loan's criteria. It includes property maintenance and payment of property taxes and insurance.

Tax-Free Income

The amount you get from a jumbo reverse mortgage is usually tax-free. It is considered loan advances rather than income. This might be a big benefit for retirees who want to boost their income without increasing their tax liability.

Requirements for a Jumbo Reverse Mortgage

Qualification for a jumbo reverse mortgage requires meeting specific criteria. Here are the main requirements of a jumbo reverse mortgage:

Age Requirement

Like the traditional reverse mortgage, a jumbo reverse mortgage requires a minimum age of 62. This criteria ensures that the product is utilized as a retirement tool.

High-Value Property

A jumbo reverse mortgage is a financial plan for residences exceeding the FHA's lending guidelines. To be qualified for a jumbo reverse mortgage, your property's worth must exceed the FHA maximum. The actual minimum amount required may vary by lender.

Financial Assessment

Lenders will conduct a financial assessment to ensure you can afford to maintain your property and pay property taxes, insurance, and other connected charges. This assessment helps avoid default and ensures you can satisfy your loan commitments.

Primary Residence

The home against which you will get the loan must be your primary residence. You must live in it, and if you move out or sell it, the loan becomes due. Jumbo reverse mortgages are not for commercial or rental properties.

Home Equity

A jumbo reverse mortgage requires a considerable amount of home equity for qualification. Typically, lenders want at least 50% equity in your property, but this can vary.

How to Qualify for a Jumbo Reverse Mortgage

Qualifying for a jumbo reverse mortgage is similar to qualifying for a traditional one. However, the focus is higher on your property's value and financial stability.

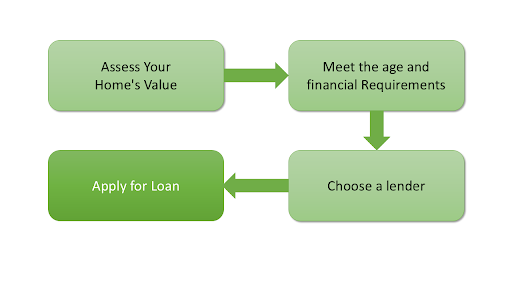

Following is the step-by-step process for jumbo reverse mortgage qualification:

Step 1: Assess Your Home's Value

The first step is determining if your home's value qualifies for a jumbo reverse mortgage. This typically involves an appraisal by a certified professional to establish the market value.

Step 2: Meet the Age and Residency Requirements

Ensure that you meet the age requirement of 62 or older and that the property is your primary residence.

Step 3: Choose a Lender

Research and select a lender that provides jumbo reverse mortgages. Examining rates, terms, and fees is critical to determine the best solution for your needs.

Step 4: Apply for the Loan

Once you've decided on a lender, you'll need to go through the application process. It involves a financial evaluation, property appraisal, and credit checks.

Jumbo Reverse Mortgage Rates and Lenders

Jumbo reverse mortgage rates vary greatly based on the lender, the property's worth, and the borrower's financial background. It is important to compare other lenders' offers to ensure you obtain the best rate and terms.

Current Jumbo Reverse Mortgage Rates

The current interest rates for jumbo reverse mortgages for seniors vary significantly based on the lender, loan terms, and market conditions. Because these loans are often for greater amounts, lenders frequently charge higher interest rates to compensate for the additional risk.

Furthermore, prices can vary depending on whether the lender offers fixed or adjustable rates. Adjustable rates have the potential to fluctuate over time. Borrowers should evaluate rates from several lenders and examine the long-term impacts of both rate choices before selecting.

FAQs

Is a Jumbo Reverse Mortgage Worth It?

Deciding whether the jumbo reverse mortgage is worth it depends on individual requirements. This is the best option if you have no other retirement plan and want to leverage your house for extra income. However, it is important to weigh your pros and cons before you apply for jumbo reverse mortgage loans to maximize your benefit.

.png)

How Do You Qualify for a Jumbo Reverse Mortgage?

To qualify for a reverse mortgage loan, the basic requirements are age above 62 and the ownership of a high-value property. Once you qualify for the financial assessment, you can qualify for a jumbo reverse mortgage.

Is a Jumbo Reverse Mortgage Safe?

A jumbo reverse mortgage loan is safe if you work with a reputable lender. You should understand the terms and conditions properly before signing up for it. This will help you reach your financial goal safely.

What is the Maximum Loan Amount for a Jumbo Reverse Mortgage?

The current maximum loan amount for a jumbo reverse mortgage is up to 4 million. However, the loan amount may vary depending on the value of your home. Make sure to discuss these details with your lender before application.

Conclusion

A jumbo reverse mortgage is an excellent financial plan for senior citizens with a luxury property. They can unlock significant equity through their property to secure their future. Whether you need a stable retirement income, cover medical expenses, or enjoy a luxury lifestyle, a jumbo reverse mortgage is your answer.

However, it is important to fully understand the terms, benefits, and risks involved in the process. For personalized advice, contact a professional advisor. They will help you find a suitable lender that will allow you to reach your financial goal.

So, contact Equity Access Group for your personalized consultation today! Visit our resources page to explore how a jumbo reverse mortgage can help you access more equity.

.jpg)

Where should we send your Free Jumbo Reverse Mortgage kit?

Fill Out The Form Below & Get a Free Reverse Mortgage Information Kit.