Flexible Loan Terms

Lenders offer flexible loan payment terms. You can get a lump sum amount, monthly allowance, or line of credit to suit your requirements.

The Proprietary Reverse Mortgage, also known as a Jumbo Reverse Mortgage, is a type of loan designed especially for high-value homes. It is not federally insured and, therefore, is considered a private service provided by the lender.

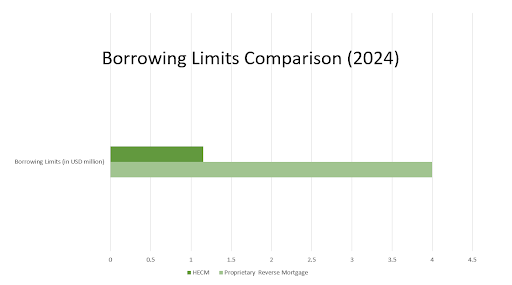

If you own a luxury house, you might not be able to get maximum equity in your property through traditional reverse mortgages. With proprietary reverse mortgages, borrowers can take up to $4 million.

The loan cap depends majorly on the value of their property and not the federal limit. With a larger loan amount, you can improve the quality of your life after retirement.

Both proprietary and traditional reverse mortgages allow homeowners to turn their home equity into cash. However, there are some significant differences between the two. That is:

Proprietary Reverse Mortgages are especially helpful for homeowners whose properties are worth more than the FHA lending limit. These loans are ideal for residents who want a loan that is better suited to their financial condition.

Proprietary and traditional reverse mortgages have significant differences in terms and conditions. Here’s a side-by-side comparison of both:

Feature |

Proprietary Reverse Mortgage |

Traditional Reverse Mortgage (HECM) |

Loan Limits |

No federal loan limits |

Strict FHA loan limits |

Insurance |

No mortgage insurance |

Requires mortgage insurance |

Eligibility Age |

As low as 55 years |

62 years |

Counselling Requirement |

Not mandatory |

Mandatory |

Property Value |

Higher value homes |

Properties meeting FHA criteria |

Flexibility in Terms |

High |

Moderate |

Proprietary reverse mortgages are quite beneficial for people with luxury homes. Some of the top pros of opting for this loan include:

Lenders offer flexible loan payment terms. You can get a lump sum amount, monthly allowance, or line of credit to suit your requirements.

Since a proprietary reverse mortgage is for high-value houses, you have access to more home equity cash than HECM. The federal government does not set strict limits for this loan.

Like the traditional reverse mortgage, you don’t have to pay back the loan monthly. It is paid off when the borrower sells the house, movies out permanently, or passes away.

The best part about proprietary reverse mortgages is that you do not have to lose ownership of the house. This allows borrowers to stay in their homes while accessing their equity.

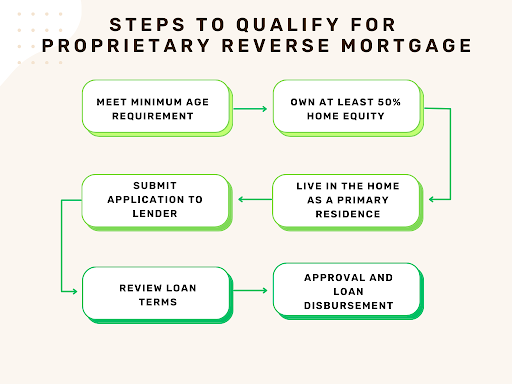

To qualify for a Proprietary Reverse Mortgage, borrowers must meet specific criteria. These requirements cab can vary by lender but generally include:

Borrowers must be at least 55 years old. Some lenders, like the HECM regulations, might require a minimum age of 62. To get the most out of a Proprietary Reverse Mortgage, the property should be worth more than the HECM’s lending limit.

.png)

Proprietary Reverse Mortgages, unlike HECMs, do not require as stringent credit and income checks. However, lenders will consider the borrower's capacity to pay property taxes, homeowner's insurance, and maintenance fees.

These loans are normally offered for single-family homes, condos, and some multi-family homes. The house must be in decent shape and does not require considerable repairs. You may only qualify for the loan once those repairs are done.

How Does a Proprietary Reverse Mortgage Work?

The borrower must fill out the application by the selected lender, attach your documents, and submit it. The lender will assess your application to determine your eligibility.

.png)

Once your application is approved, the lender will provide the terms and conditions of the loan, which include the loan amount, interest rates, and service fees.

The borrower can then access the loan amount, which can be in the form of a lump sum, monthly amount, or line of credit.

You do not have to repay the loan monthly. So, the loan is paid off when the borrower sells the house, permanently moves out, or passes away. Any equity that is left over belongs to the homeowner or their heirs.

.png)

The main pros and cons of Proprietary Reverse Mortgage are:

.png)

Qualifying for a proprietary reverse mortgage is simple. Here’s how to qualify for this loan in 2025:

Make sure your property is eligible for a proprietary reverse mortgage. You also need to meet the age requirement of your chosen lender.

Fill your application with full attention. Provide all the necessary documentation required by the lender to improve your chances of qualification.

The lender will arrange for a home evaluation to determine the current market value. It is an important step for any reverse mortgage. If your house requires any repair, you will have to get it done before applying.

Make sure to carefully review the loan terms before signing. You need to understand all the terms, interest rates, and your property’s value to get the most out of your loan.

Failure to compare multiple offers, forgetting to read the fine print, or misinterpreting the loan's fees can all result in unfavorable terms. These small mistakes can even disqualify you from getting a loan.

To be eligible, a homeowner must own a high-value property and be at least 55 years old. The lender may want more financial evaluations.

Unlike standard reverse mortgages, proprietary reverse mortgages do not have a federally mandated loan cap. This allows borrowers to get potentially larger loan amounts for high-value homes.

Proprietary Reverse Mortgages are legitimate financial plans, but they do not have the same legal safeguards as traditional reverse mortgages. Before proceeding, make sure that you completely understand the terms and consult with a professional.

Fill Out The Form Below & Get a Free Reverse Mortgage Information Kit.